2026 Eurobond issue

Eurobond issue announced for 2026

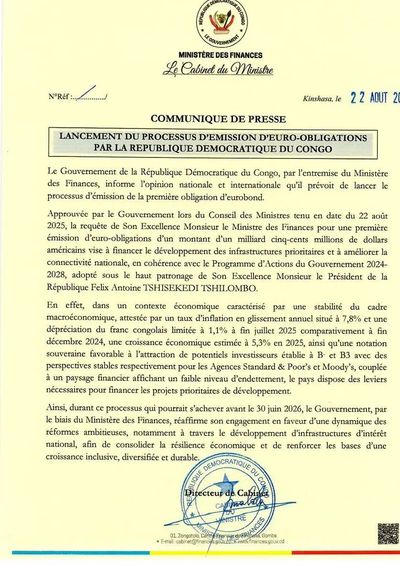

On August 22, 2025, the Ministry of Finance announced the issue of a Eurobond obligation.

The Democratic Republic of Congo's Council of Ministers officially authorized the government to prepare its first-ever Eurobond issuance, Minister of Finance Doudou Fwamba Likunde announced on August 22, 2025. The $1.5 billion loan is expected to be launched before June 30, 2026.

According to an official statement published on LinkedIn, the funds raised will be dedicated to "financing priority infrastructure and improving national connectivity, in line with the Government Action Program for 2024-2028."

The initiative comes as the DRC shows relative macroeconomic stability, with inflation at 7.8% year-on-year, and a contained depreciation of the Congolese franc at 1.1% since December 2024. Economic growth is estimated at 5.3% in 2025. The country holds speculative sovereign ratings (B- by S&P and B3 by Moody's), but with stable outlooks. Its public debt remains relatively low at around 22.5% of GDP, providing additional borrowing capacity.

The Ministry of Finance has yet to release a precise timeline for the operation, but it is not certain to take place in 2025. The use of international markets was not included in the 2025 finance law, its June amendment, or the most recent IMF report related to the ongoing Extended Credit Facility program. The financial groups that will be mandated to arrange the operation are also yet to be announced.

Citi, which ranked first for debt arrangements in sub-Saharan Africa in the first half of 2025 according to a Reuters ranking, is a potential candidate to lead the operation, especially given its subsidiary in the DRC and the country’s joint actions with the United States to bring lasting peace to its eastern region. South African group Standard Bank, which is in the top 10 of regional debt arrangers and also has a subsidiary in Kinshasa, could be involved.

The interest rate at which Kinshasa will borrow remains a significant unknown. Investors will likely look for comparisons with companies operating in the DRC, such as Ivanhoe Mines, which secured a $750 million five-year loan at an annual interest rate of 7.87% in late January 2025. While a sovereign borrower generally receives more favorable terms, the risk premium imposed on Congo could bring its rate closer to that figure, particularly given the uncertain security and fiscal context.

A successful operation would strengthen the DRC's financial credibility and expand its access to international markets beyond the support of the IMF and the World Bank. However, an overly expensive issuance could weigh on the budget for years and weaken the macroeconomic trajectory, which is already under security and social pressures.

25 August 2025

Idriss Linge

Copyright © 2025 AYANTIS